Introduction

Meal deductions have long been a topic of interest for individuals and businesses alike. With the ever-changing tax landscape, it is crucial to understand whether meals are deductible in 2023. This article aims to delve into the topic, providing a comprehensive overview of meal deductions, their eligibility criteria, and the latest tax regulations. By the end of this article, readers will have a clearer understanding of whether meals are deductible in 2023 and the potential implications for their financial situations.

Understanding Meal Deductions

What are Meal Deductions?

Meal deductions refer to the expenses incurred on food and beverages consumed during business-related activities. These deductions are meant to offset the costs associated with dining out or ordering meals while conducting business. However, not all meal expenses are eligible for deduction, as there are specific criteria that must be met.

Types of Meal Deductions

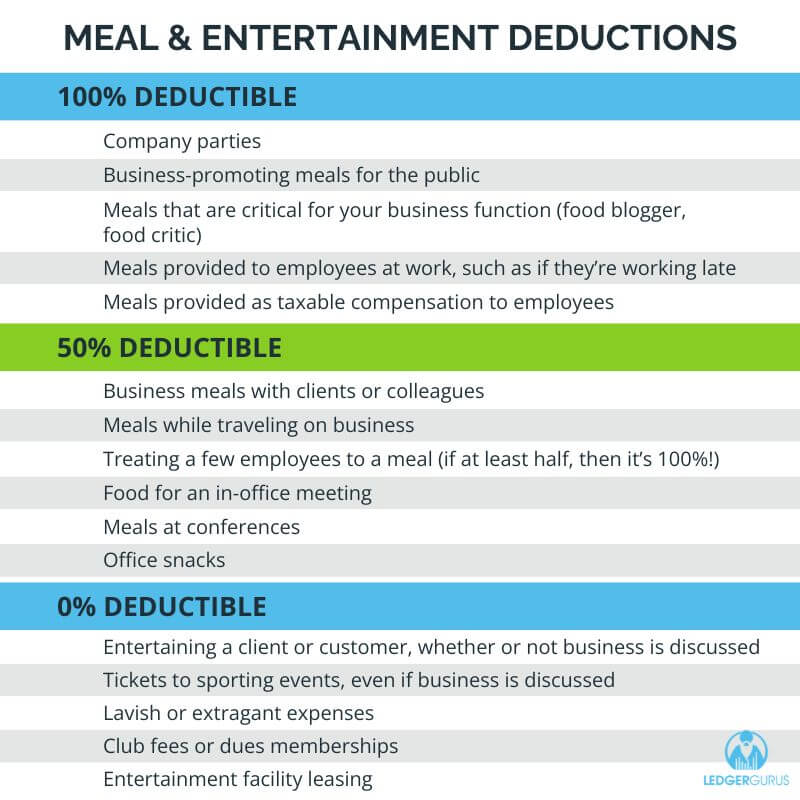

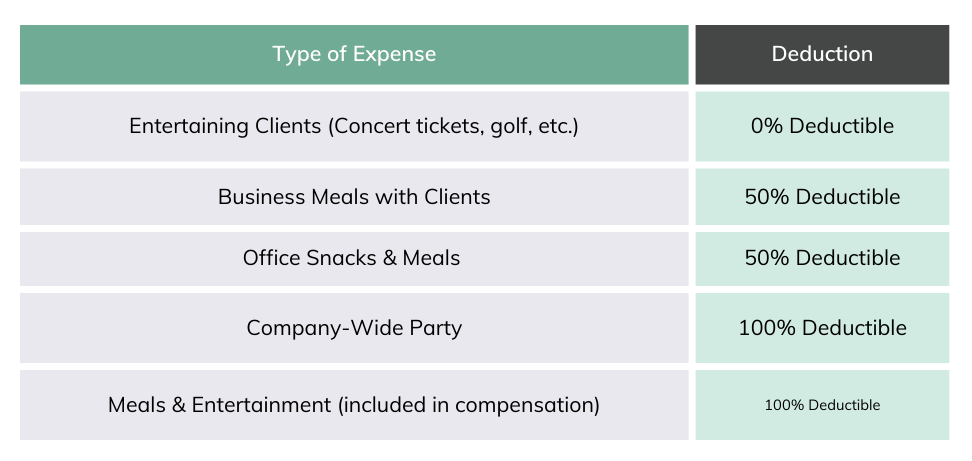

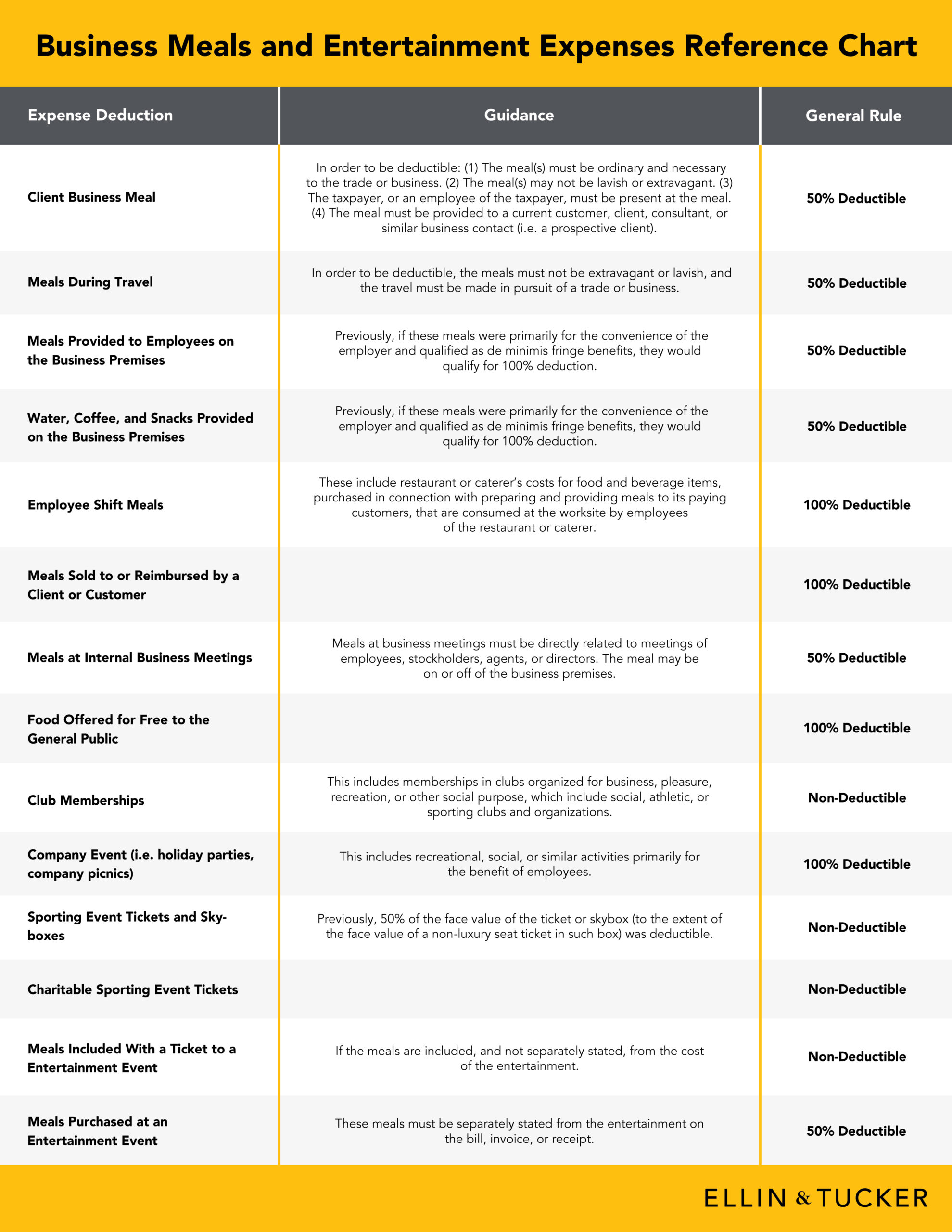

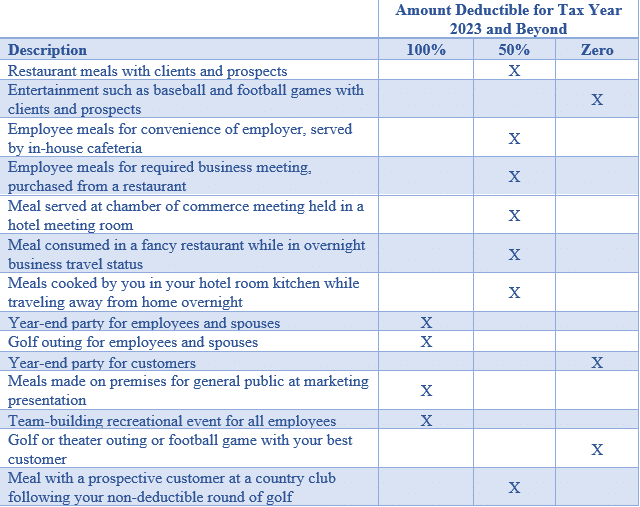

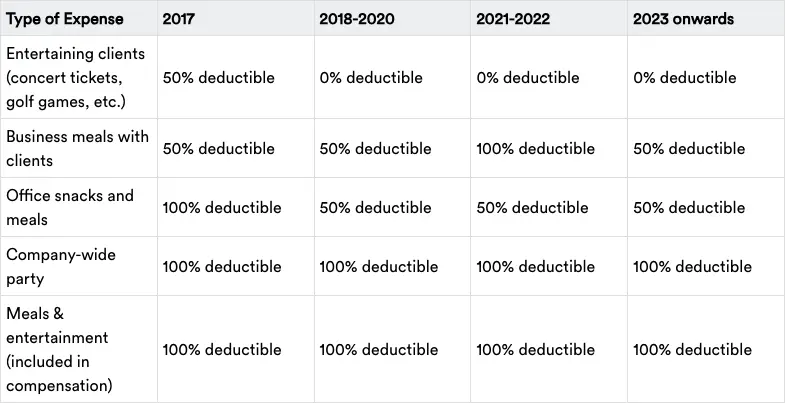

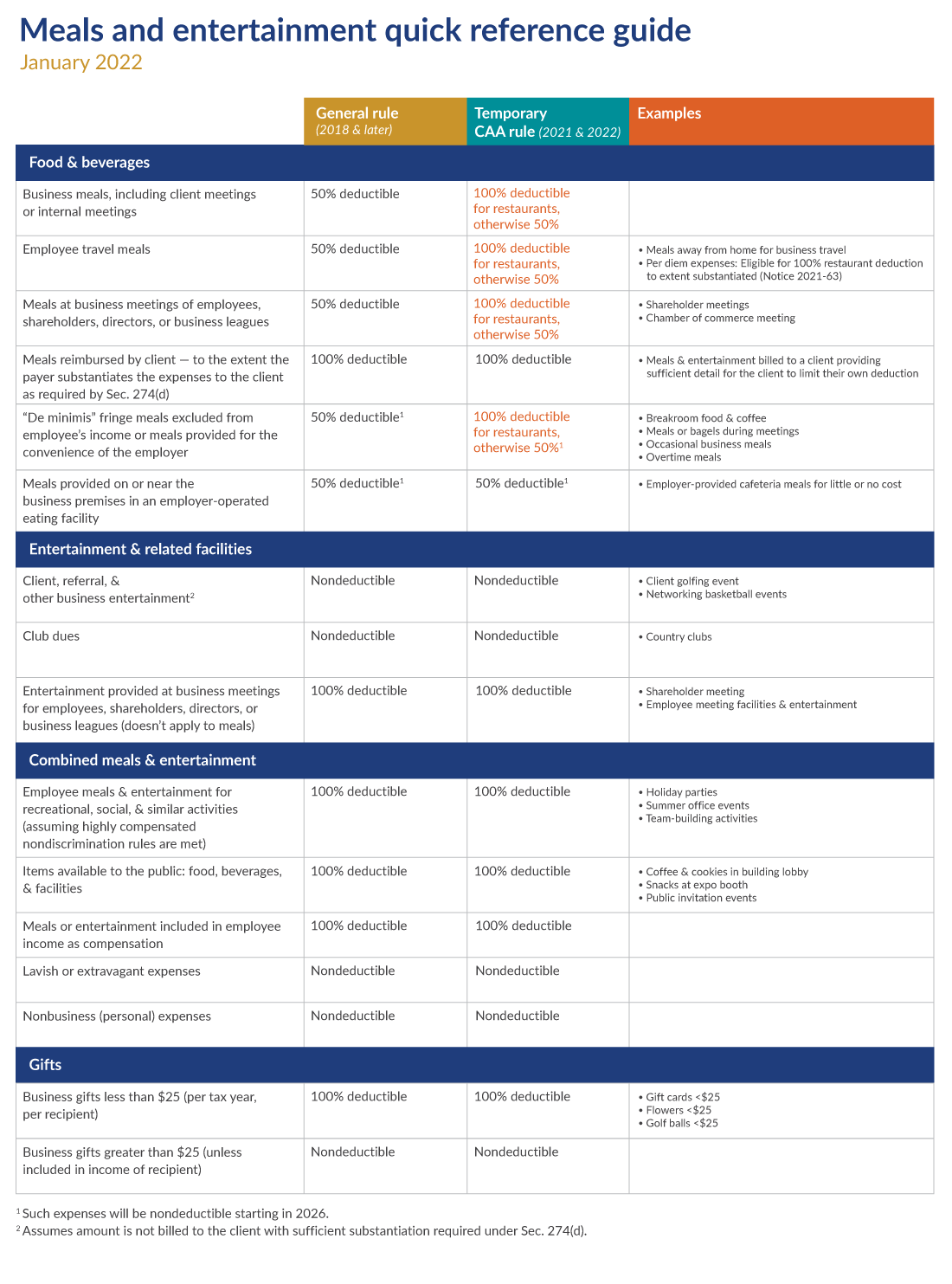

1. Client Entertainment: Expenses incurred on entertaining clients or customers for the purpose of conducting business are generally deductible. This includes meals, drinks, and other related costs.

2. Employee Meal Deductions: Employers may deduct meal expenses incurred on providing meals to employees for the convenience of the employer. However, certain conditions must be met, such as the meals being provided on the employer’s premises.

3. Travel Meal Deductions: Expenses incurred on meals while traveling for business purposes are also deductible. This includes meals during the travel days and while staying at a temporary workplace.

Eligibility Criteria for Meal Deductions

Client Entertainment

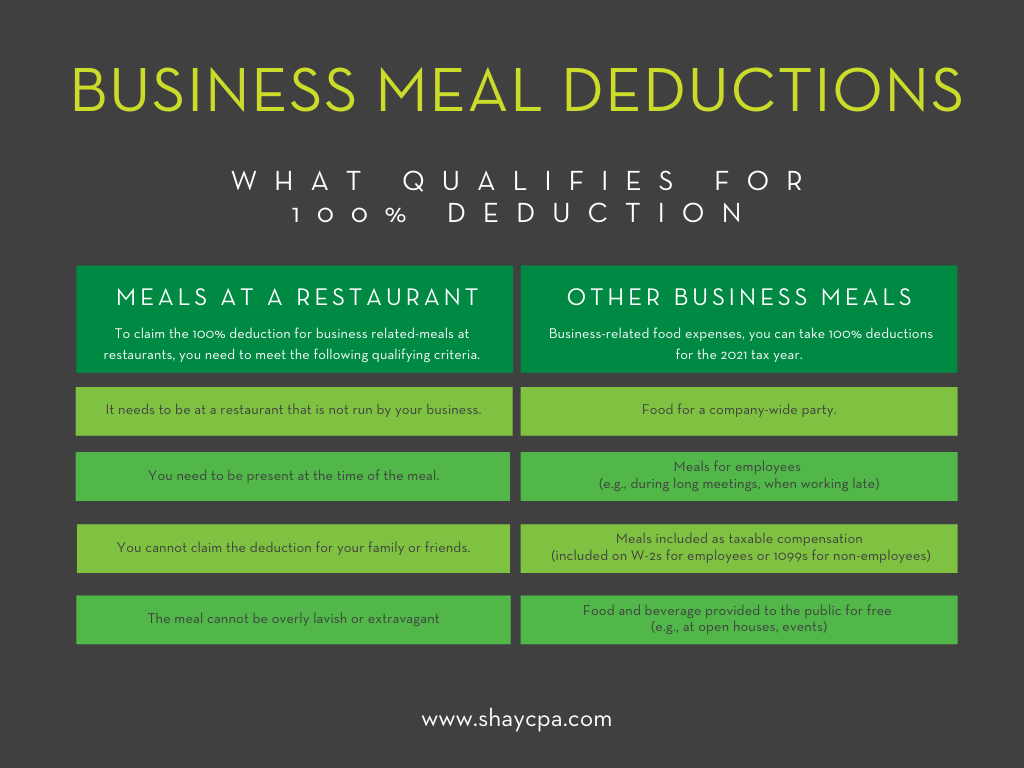

To be eligible for a client entertainment deduction, the following criteria must be met:

1. Business Purpose: The meal must be directly related to the conduct of business. This can be demonstrated through the presence of a business discussion or the intention to establish a business relationship.

2. Reasonable Expense: The expense must be reasonable in relation to the nature of the business and the type of entertainment provided.

3. Record Keeping: Proper documentation, such as receipts and records of the business discussion, is essential to substantiate the deduction.

Employee Meal Deductions

For employee meal deductions, the following conditions must be met:

1. Convenience of the Employer: The meals must be provided for the convenience of the employer, such as providing meals during working hours to ensure the continuity of business operations.

2. Provided on Employer’s Premises: The meals must be provided on the employer’s premises, and the employees must be required to be on the premises for a substantial period of time.

3. Record Keeping: Proper documentation, such as time sheets and meal records, is necessary to substantiate the deduction.

Travel Meal Deductions

To be eligible for travel meal deductions, the following criteria must be met:

1. Business Travel: The meals must be incurred during business travel, including travel days and while staying at a temporary workplace.

2. Reasonable Expense: The expense must be reasonable in relation to the nature of the travel and the type of meals consumed.

3. Record Keeping: Proper documentation, such as receipts and travel logs, is essential to substantiate the deduction.

Tax Regulations in 2023

Tax Cuts and Jobs Act (TCJA)

The Tax Cuts and Jobs Act (TCJA) of 2017 significantly impacted meal deductions. Under the TCJA, the deduction for business meals provided to clients or customers was suspended for expenses incurred after December 31, 2017, and before January 1, 2026. However, meal deductions for employees and travel meals remain eligible for deduction.

IRS Guidance

The IRS has provided guidance on meal deductions under the TCJA. According to the IRS, the suspension of the client entertainment deduction does not apply to expenses incurred for food and beverages provided to a current or potential customer at a meal facility on the employer’s business premises. This means that certain employer-provided meals may still be deductible.

Conclusion

In conclusion, meal deductions remain a crucial aspect of tax planning for individuals and businesses. While the TCJA suspended the deduction for client entertainment, meal deductions for employees and travel meals continue to be eligible. It is essential to understand the eligibility criteria and tax regulations to ensure proper deduction of meal expenses. By adhering to the guidelines and maintaining proper documentation, individuals and businesses can maximize their meal deductions and potentially reduce their tax liabilities.

Recommendations and Future Research

To further enhance the understanding of meal deductions, the following recommendations and future research directions are proposed:

1. Educational Resources: Develop comprehensive educational resources to help individuals and businesses navigate the complexities of meal deductions.

2. Tax Planning Strategies: Explore tax planning strategies that can optimize meal deductions, considering the evolving tax landscape.

3. Impact of Tax Reforms: Conduct research on the impact of tax reforms, such as the TCJA, on meal deductions and their implications for individuals and businesses.

4. International Meal Deductions: Investigate the eligibility criteria and tax regulations for meal deductions in different countries, particularly for multinational corporations.

By addressing these recommendations and conducting further research, a clearer understanding of meal deductions can be achieved, ultimately benefiting individuals and businesses in their tax planning efforts.